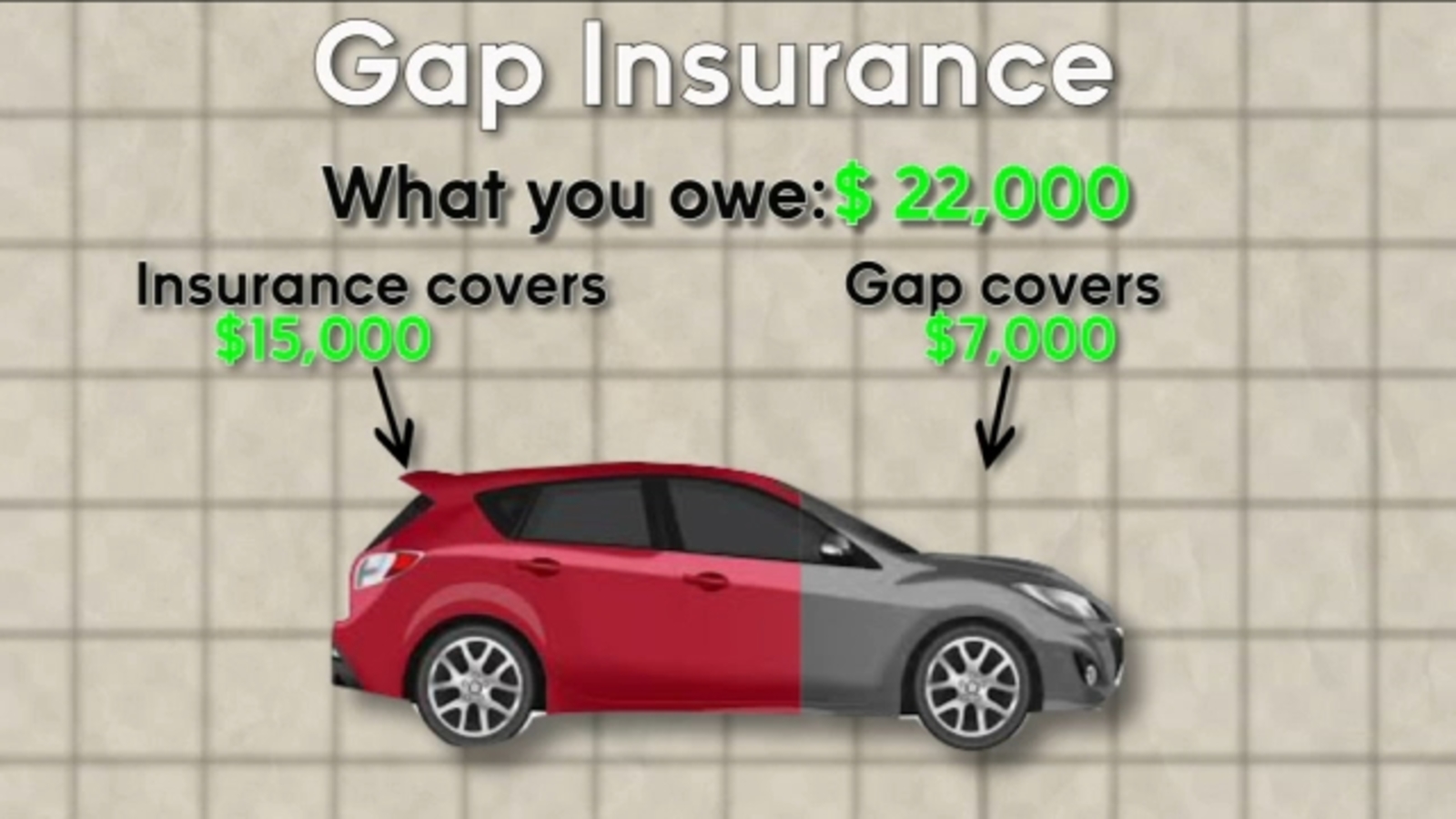

Gap insurance is an important type of insurance that is often overlooked, but it can provide a variety of benefits for drivers. Gap insurance is an insurance policy that helps cover the difference between the amount owed on a vehicle loan or lease and the actual cash value of a vehicle, if it is damaged or stolen. The cost of Gap Insurance is very affordable equaling 2% of the amount financed on a loan.

This type of insurance can be a lifesaver if a driver’s vehicle is totaled or stolen, as it can provide the funds needed to pay off the remaining loan balance and allow them to purchase another vehicle. One of the primary benefits of gap insurance is that it can help protect a driver’s financial security. When a vehicle is totaled or stolen, the insurance company may only pay out the actual cash value of the vehicle, which is typically lower than the loan balance.

Without gap insurance, the driver may be responsible for paying the difference out of pocket, which could be a significant amount of money. Another benefit of gap insurance is that it can help protect a driver’s credit score. If a driver is unable to pay off the remaining loan balance after their vehicle is totaled or stolen, their credit score could be negatively affected.

Finally, gap insurance can provide peace of mind. No one likes to think about the possibility of their vehicle being totaled or stolen, but it is a reality that many drivers face. In conclusion, gap insurance can provide a variety of benefits for drivers. It can help protect a driver’s financial security, credit score, and peace of mind, making it an important type of insurance to consider.